…Or is it?

Being on the home stretch to Christmas means a time of reflection:

What are you thankful for?

Are you where you thought you would be at this time of year?

Do you have the funds to pay for this expensive time of year?

While this is the giving time of year, where even those with a bit of Grinch walk with a little skip in their step and let others go first in traffic, many people deep down have the sinking feeling of needing to reach to debt (Credit Cards/Loans) to keep up with the Jones’s.

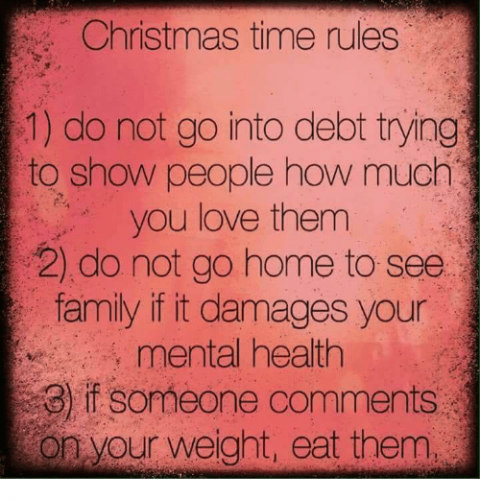

Christmas time can be one of the most stressful times of the year for many people. Here is how my tribe survive while still liking each other and not hitting the plastic.

Get every one on the same plan

Make a simple plan, and stick to it throughout the year. For many couples and/or families, there are savers and spenders. This can cause many issues, particularly when it comes to planning ahead for expenses. Sit down, as a family, and work out what you want to achieve – the more you can all get on the same page, the more likely you are to succeed.

This type of planning Christmas in our household has worked to determine what we want for ourselves, what we want to give others, how we can give to those less fortunate than ourselves, and how we are going to pay for all of this.

Our plan for this year to pay for the presents from the kids, was to not spend any $5 notes that came our way. The kids were aware of this, and we had them onboard throughout the year, and involved in celebrating when we cracked the tin.

Why is there a pineapple in there?

We cracked the tin… and had squirrelled away a little bit more than what we saved last year. And yes, other notes made it to the tin – sometimes extra notes still in the wallet on pay day would get put in the tin to boost our savings.

Plan to have a Debt Free Christmas

No one likes opening the mail from mid January. The Credit Card statement arrives, all the bills get together to have a party in your mailbox and then you have to start thinking school lists.

Consider these tips with your Christmas Planning:

- Cut up the Credit Card – if you have already started putting your Christmas shopping on a credit card or the new and not-improved form of LayBy “AfterPay”, stop now!

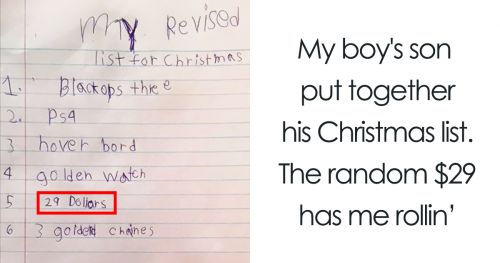

- Write down what gifts and other preparations you still need to buy. Place a dollar value against each line and total them, this is your Christmas Budget.

- Count how many pay days you have until Christmas, divide the total in the budget by the numbers of pay days, this is how much you need to find each pay. If this is not possible, then revise your list.

- Think of cheaper alternatives for gifts, yes, even homemade. If you have an awesome recipe, you can give your peeps the recipe as well as some of the pantry ingredients.

- Think of cheaper ways to give. This year my family is doing sock presents for the adults. We have each been given someone to buy for (we will not be together on the big day) and we each must fill the sock with gifts at a budget.

- Think more of experiences than gifts. A favourite movie night for the kids at home can be packaged into a hamper of movie snacks.

- For other budget lines, keep paying everything else that you ordinarily do. Pay a little off each of your regular bills with each pay to avoid bill-shock when they arrive in the New Year.

- Write a list, check it twice and keep to the list.

Source: https://www.boredpanda.com/funny-kids-letters-santa/?utm_source=google&utm_medium=organic&utm_campaign=organic

In a Nutshell…

Christmas is not a surprise, happens the same date every year. You still have time to consider how to have a Merry Christmas and a Debt Free New Year. Just be mindful of every dollar and be intentional with your Christmas buying.